Institutions

Asset classes

About us

Whether you’re an asset manager, asset owner, or private markets ecosystem partner—a single platform built by and for market practitioners will help ensure your organization keeps up with the continuous pace of change.

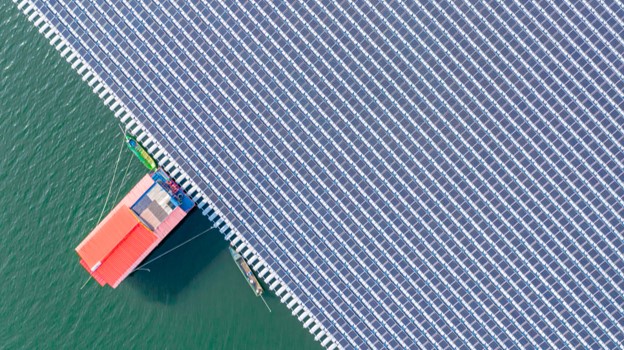

Technology and impact investing

Learn how tech is helping Acumen bring together the power of markets and philanthropy with a conversation from Chief Financial Officer Jacqueline Woo.

A new generation of private markets to technology

From automation to machine learning and natural language processing, artificial intelligence has been a part of BlackRock s DNA for years—and continues to be applied across eFront® technology.

Introducing eFront Copilot, available within eFront Insight